Taxpayers anticipate income tax relief in Union Budget 2025, focusing on standard deduction hikes under the new regime. Experts suggest changes to ensure equitable treatment.

As Finance Minister Nirmala Sitharaman prepares to present the Union Budget 2025 on February 1, 2025, taxpayers, particularly the salaried and middle class, are keenly anticipating potential income tax relief measures. The focus is primarily on the new income tax regime, which has become the default option.

Standard Deduction

A significant expectation revolves around an increase in the standard deduction. The new income tax regime has seen changes since its introduction in FY 2020-21, with more favorable tax slabs, rates, and the inclusion of a standard deduction and benefits for the National Pension System (NPS). In Budget 2024, the standard deduction under the new regime was increased to ₹75,000 from ₹50,000, while the old regime remains at ₹50,000. Taxpayers are now looking for a further hike in the standard deduction under the new regime, given its status as the default option.

Personal tax experts argue that since the new tax regime lacks major exemptions and deductions, increasing the standard deduction is crucial to encourage its adoption. Some experts even suggest setting the standard deduction as a fixed percentage of income. Experts propose raising the standard deduction to ₹1,00,000 from the current ₹75,000 under the new tax regime to make it more appealing, since no other significant deductions or exemptions are available. This would provide relief to all income groups, enhance disposable income, stimulate spending, and support economic growth, while also addressing inflationary pressures.

Professionals and business people can claim actual expenses against their income, and those eligible for presumptive taxation also benefit from assumed expenditures. However, salaried taxpayers under the new regime have limited deductions, only the standard deduction and employer contributions to NPS. Thus, an increase in standard deduction can ensure equitable treatment to them as compared to others. Some experts propose to have the standard deduction as a fixed percentage of income, similar to the 30% standard deduction on rental income. This will ensure equity across all income groups.

Old vs New Tax Regime

There is a debate on the future of the old tax regime. With the government’s focus on promoting the new tax regime, some experts believe it is unlikely that there will be an increase in standard deduction under the old tax regime. There is speculation that the old tax regime might be phased out, given the increasing number of taxpayers opting for the new system. The government expects taxpayers to report their actual income, which aligns with the new tax regime, so it may happen sooner rather than later.

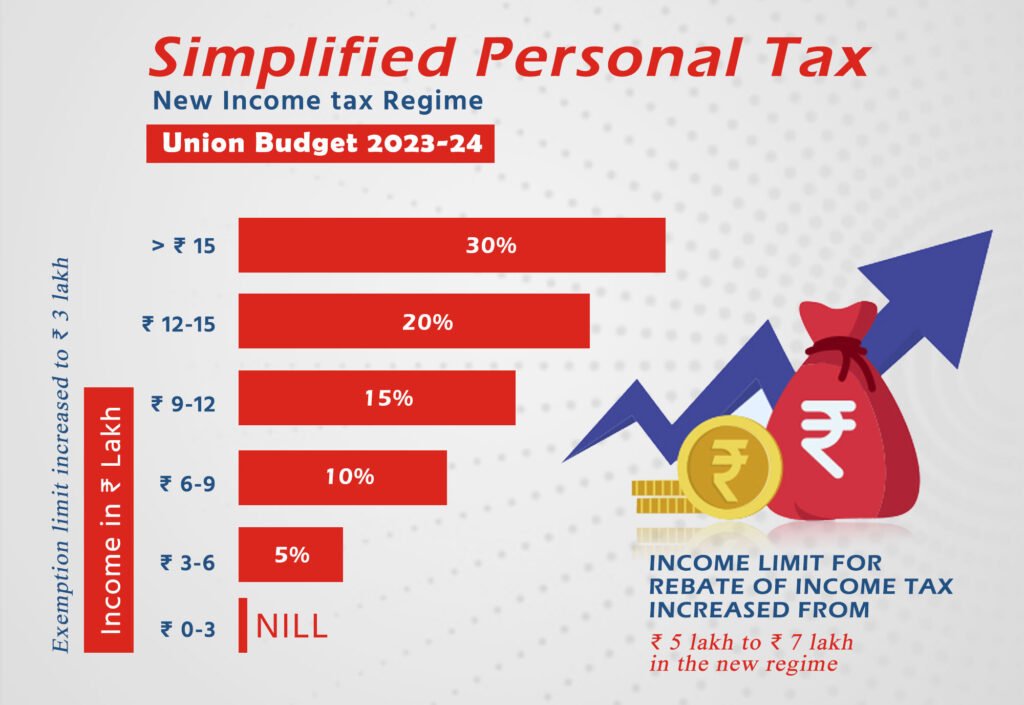

Currently, there are two tax regimes: the Old Regime, with various deductions, and the New Tax Regime, with lower base rates but no such deductions. The new tax regime has been introduced to simplify the tax structure. It offers a tax rebate on income up to ₹7 lakh, while the old regime’s rebate is limited to ₹5 lakh. The new regime currently has a standard deduction of ₹75,000 for salaried individuals, while the old regime has a standard deduction of ₹50,000. Most deductions and exemptions under sections 80C, 80D, and HRA are eliminated under the new tax regime.

Budget 2025 Expectations

Taxpayers expect clarity on whether the old tax regime will continue, be altered, or be discontinued. Many are also anticipating announcements that might simplify the tax structure. There are speculations that the government might merge the tax systems, constraining the New Tax Regime to a compulsory use system and doing away with traditional exclusion benefits. However, there has been no official announcement regarding any such merger, and the government is yet to provide any clarity.

The Budget 2025 will be presented on February 1. The Parliament’s budget session is scheduled to start on January 31 and conclude on April 4. All eyes will be on the major announcements of the Modi 3.0 era on February 1.

Sources: https://timesofindia.indiatimes.com/business/india-business/budget-2025-income-tax-why-standard-deduction-should-be-hiked-under-new-tax-regime/articleshow/117672539.cms

https://www.livemint.com/money/personal-finance/budget-2025-will-fm-nirmala-sitharaman-bid-goodbye-to-the-old-income-tax-regime-all-eyes-on-february-1-announcements-11738136228850.html

https://www.deccanherald.com/business/economy/india-inc-expects-union-budget-to-prioritise-job-creation-3377132