Many councils in England are raising council tax due to financial difficulties. Some councils are trying to increase taxes beyond the allowed limit, potentially hitting residents hard.

Several local councils in England are facing severe financial difficulties, leading to significant increases in council tax for residents. Many local authorities are struggling with the rising costs of public services and are seeking permission to raise taxes beyond the government-imposed limit.

The Scale of the Problem

The 20 most indebted councils in the country owe over £30 billion, and this figure doesn’t account for other liabilities like pension deficits or PFI contracts. In total, local authorities have debts exceeding £140 billion. This financial strain is forcing councils to make tough choices, including raising taxes to avoid bankruptcy. Some councils have already asked the Ministry of Housing, Communities and Local Government for permission to increase taxes beyond the 4.99 percent cap set by the central government.

Council Tax Increases

Analysis suggests that more than four million households may face council tax increases of up to five times the legal limit starting in April. One council, Windsor and Maidenhead, is proposing an increase of 25 percent, which would be the largest in England in two decades. Several other councils have proposed rises between 10 and 15 percent. Under existing regulations, councils can only raise taxes by a maximum of 4.99 percent without government approval. To surpass this threshold, councils may threaten to declare bankruptcy.

Councils are also utilizing a loophole through a Section 114 notice, a report from the council’s finance officer that states the authority cannot operate within its existing budget. This allows them to justify higher tax increases by claiming they need the funds to continue providing essential services.

Councils Facing the Highest Increases

Windsor and Maidenhead is seeking a 25% increase, which translates to an additional £451 for the area’s 154,000 residents. The council stated it faced bankruptcy if it doesn’t get the increased tax revenue. Other areas with significant proposed increases include:

- Hampshire: 15% increase (1.4 million residents)

- North Somerset: 15% increase (215,000 residents)

- Bradford: 15% increase (560,000 residents)

- Newham, east London: 10% increase (358,000 residents)

- Cheshire East: 9.99% increase (406,500 residents)

- Birmingham: 9.99% increase (1.16 million residents)

- Slough: 7.99% increase (160,000 residents)

Individual Council Situations

Birmingham City Council, which declared itself effectively bankrupt in 2023, has the highest debt of any council at £3.4 billion, about £8,000 for every household in the city. The council is looking to raise council tax by 9.99 percent for the second year in a row, potentially leading to a £400 increase for Band D council tax payers over two years. Cheshire East Council has asked to raise tax by five percent above the allowable limit due to a £27 million budget shortfall.

Conservative-led Hampshire, Labour-run Bradford, and the Liberal Democrat North Somerset are all considering increases of 15 percent, adding around £170 to the average household bill.

Government Response

The Ministry of Housing, Communities and Local Government has stated that no decisions have been made regarding council tax increases, adding that they will only consider requests for increases over five percent in exceptional circumstances. The government has maintained that councils are responsible for setting their own taxes and taxpayers will be prioritized in any decision.

Resident and Advocacy Group Reactions

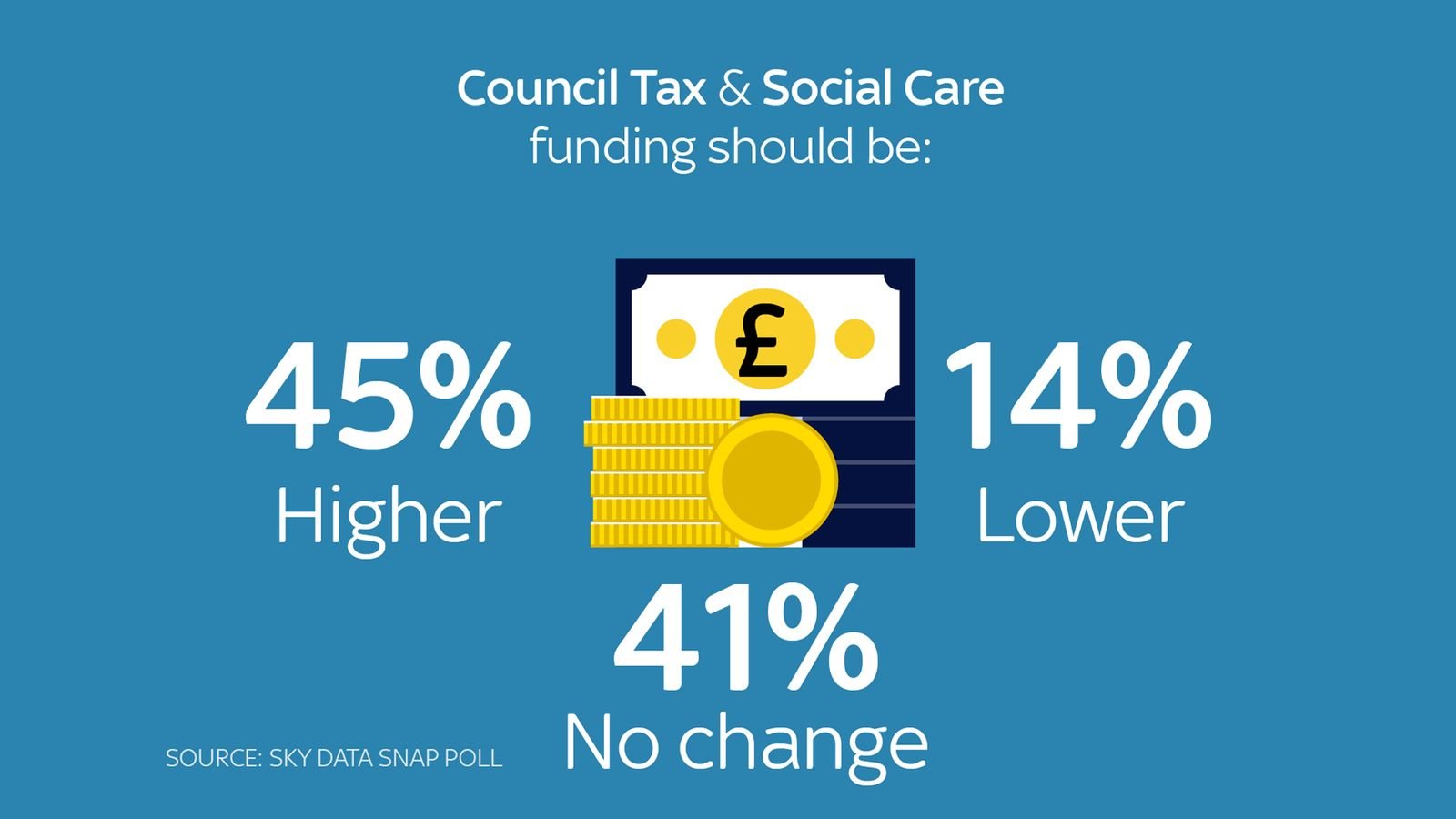

Advocacy groups, such as the Taxpayers’ Alliance, have criticized the proposed increases. They argue that the councils should not pass their mismanagement costs to the residents. There is increasing pressure on councils to balance their budgets without placing excessive burdens on residents.

Background on Council Funding

Local councils in England are responsible for providing a wide range of services, such as education, social care, waste management, and road maintenance. They are funded through a mix of government grants, council tax, and other local revenue. However, due to factors like austerity measures, increasing demand for services, and high inflation rates, many councils are struggling to balance their budgets.

Sources: https://www.thetimes.com/uk/politics/article/councils-facing-30bn-debt-crisis-seek-big-tax-rises-l5p8trfpq

https://www.independent.co.uk/news/uk/home-news/council-tax-rises-map-2025-b2687483.html

https://www.gbnews.com/politics/tory-councillor-blasts-tax-bills-hike-windsor-maidenhead