Explore India’s 2025 income tax slabs, focusing on the new regime, tax savings up to Rs 13.7 lakh for salaried individuals, and the benefits of the National Pension System.

The Indian income tax landscape is constantly evolving, and the latest changes for the 2025-26 assessment year have brought significant developments for taxpayers. Finance Minister Nirmala Sitharaman’s Budget 2025 included announcements that could lead to substantial tax savings, particularly for salaried individuals. This article delves into the details of these changes, focusing on the new income tax slabs and the tax benefits available through the National Pension System (NPS).

Zero Income Tax Up to Rs 13.7 Lakh?

One of the most significant announcements in Budget 2025 was the introduction of zero income tax for individuals earning up to Rs 12 lakh. However, for salaried individuals, this tax-free limit can potentially reach Rs 13.7 lakh. This is due to a combination of the standard deduction and NPS contributions. The standard deduction of Rs 75,000, along with the provision to invest up to 14% of basic salary in NPS, allows significant tax deductions.

How the Tax Savings Work

Let’s illustrate with an example. A salaried individual earning an annual income of Rs 13.7 lakh, with a basic salary of 50% (Rs 6.85 lakh), can contribute 14% of their basic salary, which amounts to Rs 95,900, towards NPS. This contribution, combined with the Rs 75,000 standard deduction, effectively eliminates tax liability on the entire Rs 13.7 lakh income. The table below highlights how this tax savings can be achieved:

| Basic Income (Rs Lakh) | Basic Salary (Rs Lakh) | NPS Contribution (14% of basic) (Rs) | Taxable Income (Rs Lakh) | Total Tax (Rs Lakh) |

|---|---|---|---|---|

| 13.7 | 6.85 | 95,900 | 11.99 | NIL |

| 16 | 8 | 1.12 lakh | 14.13 | 91,950 |

| 24 | 12 | 1.68 lakh | 21.57 | 2.39 lakh |

| 32 | 16 | 2.24 lakh | 29.01 | 4.50 lakh |

| 48 | 24 | 3.36 lakh | 43.89 | 8.97 lakh |

National Pension System (NPS): Key Details

The National Pension System (NPS) plays a crucial role in achieving these tax benefits. Under Section 80CCD(2) of the Income Tax Act, individuals can claim tax deductions up to 14% of their basic salary when invested in NPS. It’s essential to note that this benefit requires employer participation in NPS, as employees cannot opt for it independently. However, it’s interesting to see that even after a decade of the existence of this option, only 2.2 million individuals have enrolled. Corporates are still not actively rolling out this benefit, and employees have also shown less interest. The extended lock-in period, and limitations of withdrawal discourage the investors to invest in NPS.

NPS Benefits and Drawbacks

Benefits:

The NPS offers numerous benefits like the flexibility to select an asset mix, switch between funds, and change pension fund managers, without attracting any tax implications. Also, NPS boasts the lowest fund management charges in the industry, at 0.09% annually, enabling NPS funds to outperform mutual funds in similar categories.

Drawbacks:

The restrictions on withdrawals, particularly before retirement, and the requirement to invest 40% of the maturity amount in an annuity upon maturity, might deter potential investors. However, financial experts consider the lack of liquidity in NPS a positive attribute, as it keeps the money invested for the long term, potentially leading to enormous investment returns.

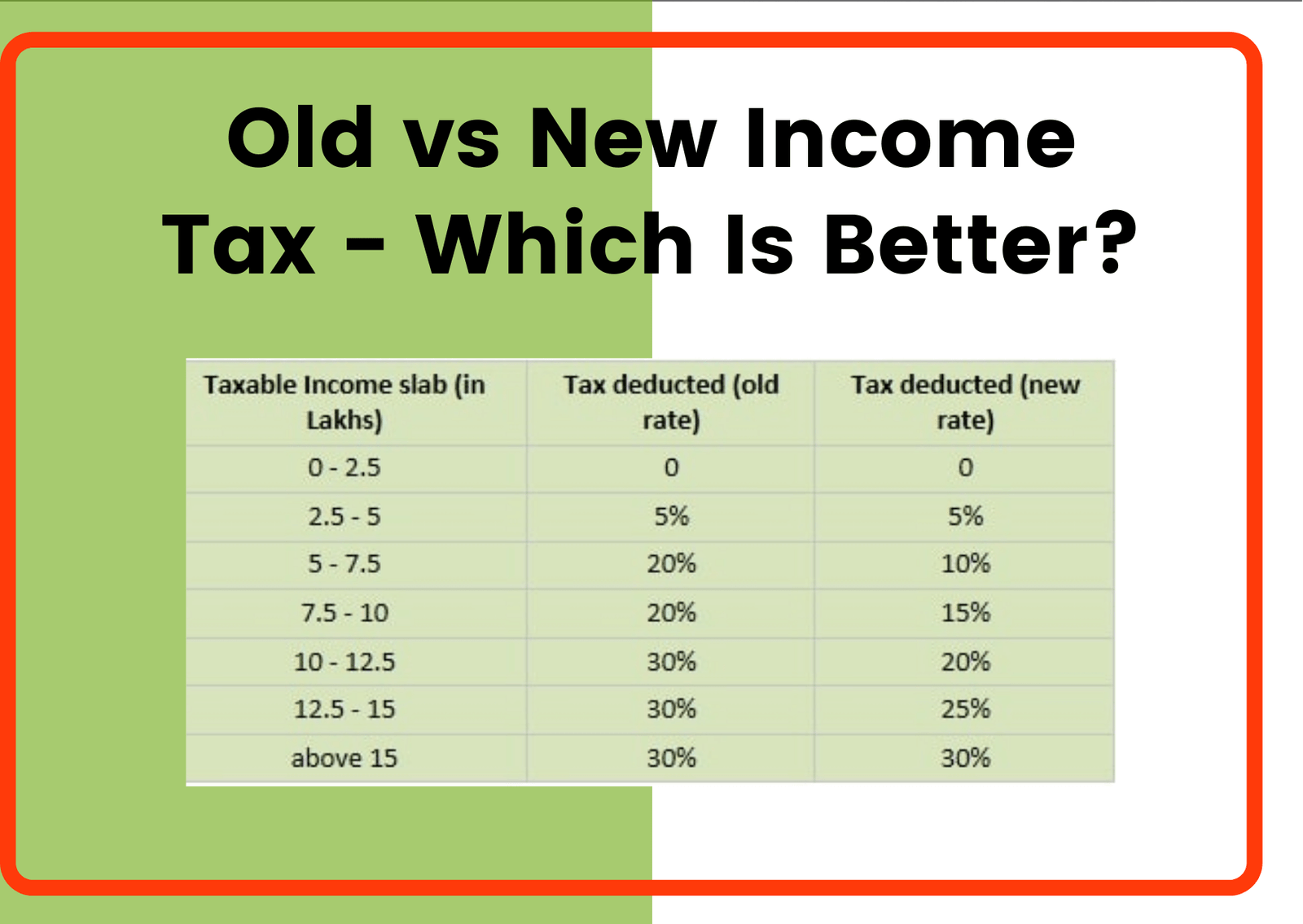

Comparison with Old Tax Regime

While the new tax regime offers zero income tax up to Rs 13.7 lakh for some salaried individuals, the old tax regime also has its benefits, including various deductions under Chapter VI-A of the Income Tax Act, like 80C, 80D, 80CCD etc. The optimal choice between the new and old tax regimes depends on the individual’s specific circumstances and investment choices.

Conclusion

The income tax landscape in India is undergoing constant change, and the Budget 2025 announcements have introduced some important changes. The possibility of achieving zero income tax on up to Rs 13.7 lakh income for salaried individuals is indeed a significant opportunity. Understanding these changes and utilizing the tax benefits offered through NPS can help taxpayers make informed decisions and potentially save a substantial amount on taxes.

Sources: https://www.indiatoday.in/newsmo/video/budget-2025-nirmala-sitharamans-tax-cuts-gst-moves-mastermind-or-middle-class-nightmare-2673446-2025-02-01

https://timesofindia.indiatimes.com/business/india-business/latest-income-tax-slabs-2025-26-budget-how-you-can-pay-zero-tax-with-rs-13-7-lakh-salary-under-new-income-tax-regime-standard-deduction-nps-investments/articleshow/117880981.cms

https://www.hindustantimes.com/india-news/why-did-govt-increase-income-tax-rebate-from-7-lakh-to-12-lakh-fm-nirmala-sitharaman-explains-101738494269705.html