Palantir’s growth is fueled by AI demand and government contracts. Strong financial performance and strategic focus are key to their success in the AI revolution.

Palantir Technologies Inc. has experienced significant growth, driven by strong demand for its software and data analytics services, particularly in the realm of generative AI. The company’s shares have seen substantial increases, reflecting investor confidence in its ability to capitalize on the AI revolution and its established position in providing services to both government and commercial sectors.

Stock Performance and Market Capitalization

Palantir shares rallied, leading to a significant increase in market capitalization. The company’s stock performance reflects the growing interest in AI-related companies and Palantir’s demonstrated ability to deliver strong results. Several analysts have raised their price targets on the stock, further indicating positive sentiment.

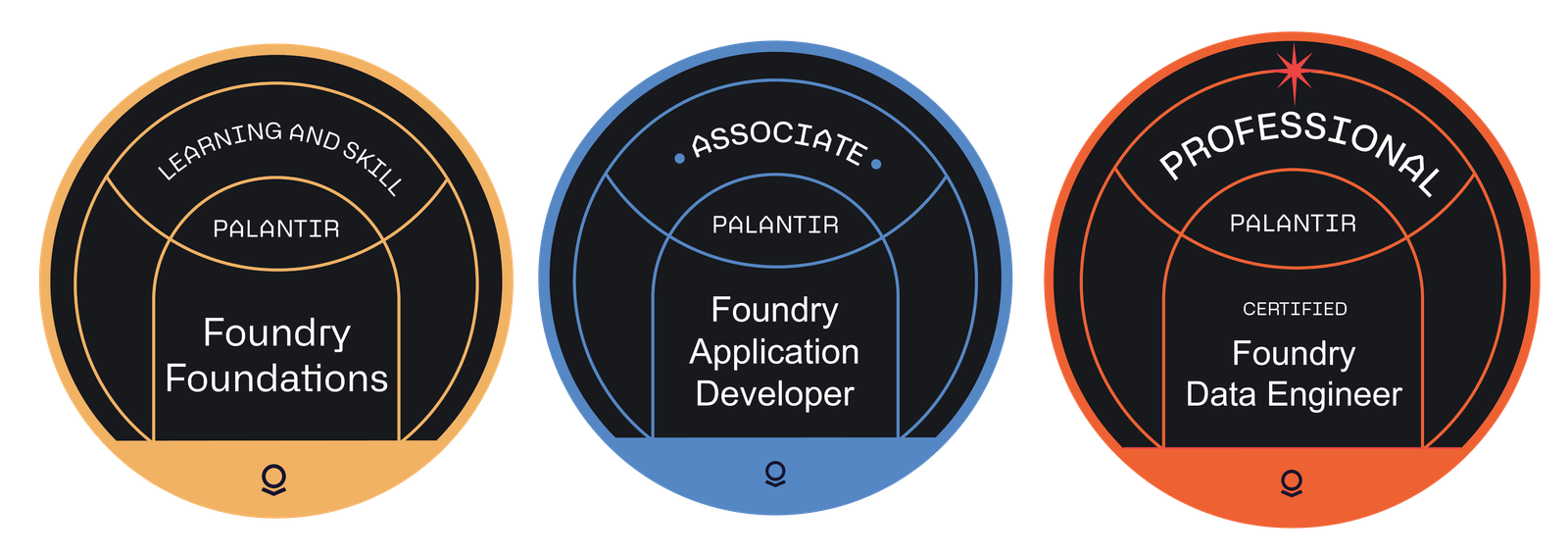

AI Platform and Services

Palantir’s platform, AIP (Artificial Intelligence Platform), is a key driver of its success. AIP is utilized for testing, debugging code, and evaluating AI-related scenarios, making it attractive to businesses looking to deploy generative AI technology. The company’s expertise in data analytics and software solutions positions it as a valuable partner for organizations seeking to improve their technological capabilities.

Executive Insights

CEO Alex Karp has emphasized the company’s position at the center of the AI revolution. He highlighted the increasing importance of AI and Palantir’s role in helping organizations navigate this technological shift. Karp also addressed concerns about competition, emphasizing the need for continued innovation and a collective effort to maintain a competitive edge.

Financial Performance

Palantir’s financial results have consistently surpassed expectations. The company’s revenue has increased significantly, driven by growth in both its commercial and government segments. Palantir has provided strong revenue guidance, indicating continued confidence in its growth trajectory.

Segment Growth

Palantir experiences robust growth in both U.S. commercial and U.S. government sectors. This balanced growth strategy contributes to the company’s overall stability and success. The company expects U.S. commercial sales to continue to rise significantly.

DeepSeek and National Security

Palantir has taken a stance on DeepSeek, discouraging commercial clients from using its AI models. This decision reflects concerns about national security implications and the importance of responsible AI development. The company remains committed to working with clients who choose to use DeepSeek’s models, while also prioritizing security considerations.

Supply Chain and Logistics Management

The potential for new tariffs and trade policies could drive demand for Palantir’s analytics services in supply chain and logistics management. The company’s expertise in these areas positions it to help organizations navigate complex global trade dynamics.

Valuation

Palantir’s price-to-earnings ratio is an important factor for investors to consider. While it may be higher than some of its peers, it reflects the company’s growth potential and its position in the rapidly evolving AI landscape.

Conclusion

Palantir’s success is underpinned by its AI platform, strong financial performance, and strategic focus on both commercial and government sectors. The company’s leadership is confident in its ability to continue to drive growth and innovation in the years to come.

Sources: https://www.ft.com/content/b9f00d80-bd60-4660-a544-3b7f79795d5f

https://finance.yahoo.com/news/palantir-shares-jump-upbeat-revenue-112234605.html

https://www.cnbc.com/2025/02/03/palantir-pltr-q4-earnings-2024.html